tax per mile california

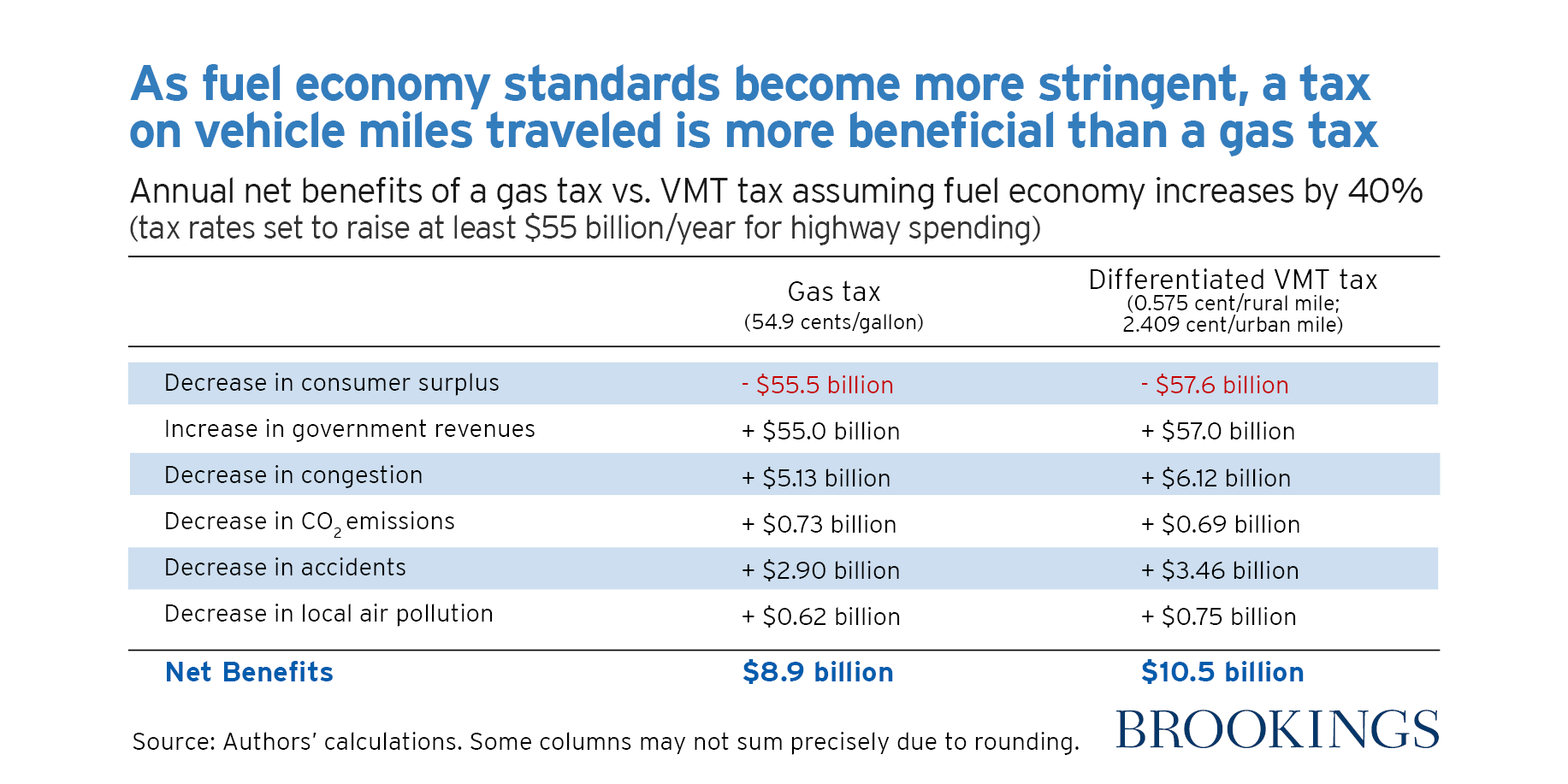

At a fee of 18 cents per mile driven which has. Instead it would be calculated on a per mile basis.

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

October 1 2021.

. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. The average American drives thirty miles a day round trip to work and in California that average is significantly higher. Now the California legislature is looking at a voluntary program that would eliminate the states gas tax which currently stands at 529-cents per gallon - second highest.

A mileage tax would not be calculated on a per gallon basis. The program is a voluntary option for drivers of eligible vehicles to pay their highway use fee on a per-mile. I voted no on SB339 a bad bill pursuing a.

Rick Pedroncelli The Associated Press. Since 2015 the program allows the state to study a road. Proponents argue that the state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under proposed state.

Commuting is a necessity in my district and a per-mile tax would be a huge blow to middle-class families Wilk said on Twitter. The California Legislature has approved a bill to extend the states road charge pilot program. But as cars get more fuel efficient or use other energy sources the gas tax will no.

Request for Transcript of Tax Return Form W-4. The board is expected to vote on the proposal Dec. What the county believes is just a 2-cent addition piles up to create around 075 per mile including an existing state-level gas tax of 0511 per gallon that increased last.

Web Tax Per Mile California. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under state legislation proposed by a Bay.

Arleta Los Angeles 9500. Hence all vehicles will have to pay the same amount as mileage tax. The program is a voluntary option for drivers of eligible vehicles to pay their highway use fee on a per-mile basis.

A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting. Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

At a fee of 18 cents per mile driven. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Since 2015 the program allows the state to study.

In Depth Recent News. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes building out. SANDAG voted Friday to begin the public comment period for a road usage charge of four cents per mile.

September 10 2021. Replacing Californias gas tax.

Sandag Leadership Looks For Alternatives To County Mileage Tax

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

California Pay Per Mile Road Charge Could Replace The Gas Tax Youtube

Local Option Transportation Taxes Devolution As Revolution Access Magazine

State To Charge Per Mile That You Drive Merced Golden Wire News

California Considering Plan To Replace Gas Tax With Charge Per Mile Driven East Bay Times

Opinion San Diego Drivers Shouldn T Be Taxed On The Miles They Drive Times Of San Diego

Why California Gas Prices Are Especially High The New York Times

Small Business Owners Aren T Happy With California S New Gas Taxes Pasadena Star News

What Are The Mileage Deduction Rules H R Block

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

A Primer On Vehicle Miles Traveled Taxation Concepts California Globe

California Sales Tax Rate Rates Calculator Avalara

Ny And Ca Spend Billions More In Taxes Than Tx And Fl And Get Worse Results

Highest Gas Tax In The U S By State 2022 Statista

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

California Considers Placing A Mileage Tax On Drivers

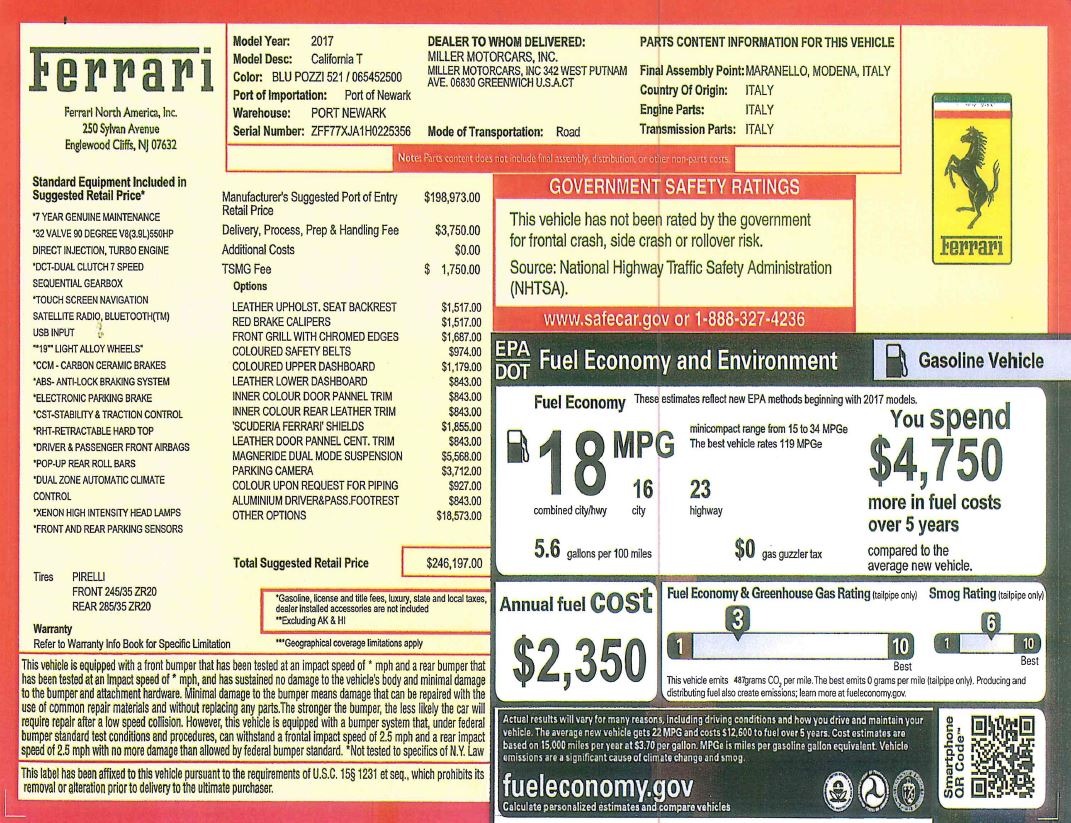

Pre Owned 2017 Ferrari California T For Sale Miller Motorcars Stock F1778b